One 97 Communications Ltd. shares continued to tumble after a bank used by the company’s popular Paytm mobile payment service was effectively shut down by banking regulators, prompting JP Morgan to recommend investors sell.

The Reserve Bank of India’s actions against PayTM Payments Bank Ltd., announced on Wednesday, included a ban on further deposits, credit transactions, use of balances by its customers or banking services.

Additionally, nodal accounts, or special intermediary accounts used by businesses, of One 97 and Paytm Payments Services Ltd. “shall be closed at the earliest” and no later than February 29.

Paytm boasts of being India’s “most popular” platform for money transfers, recharges and other online payments.

The RBI’s actions come after an investigation found “persistent non-compliance and ongoing material supervisory concerns in the bank.”

One from ’97 543396,

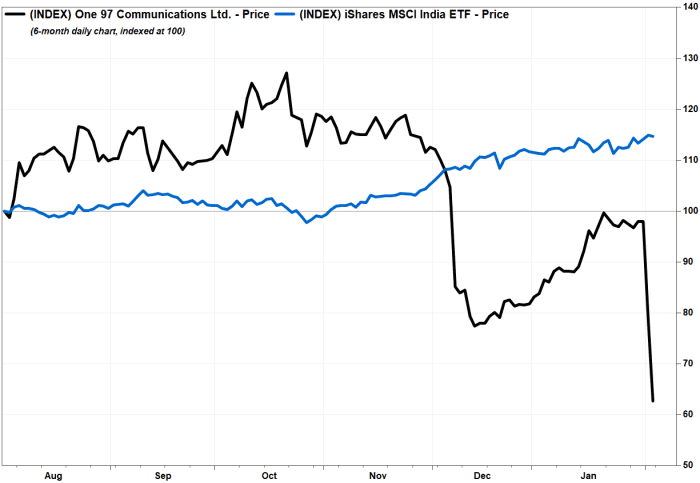

Trade in India plunged 36% in the past two days to close at a 15-month low on Friday following the RBI’s action announcement. The stock has fallen 37.3% over the past six months, while the iShares MSCI India INDA ETF has rallied 14.7%.

One 97 shares tumble after RBI took action against a bank used by Paytm.

FactSet, MarketWatch

JP Morgan analyst Ankur Rudra downgraded the stock from neutral to underweight and cut his price target by 33% to 600 rupees.

Rudra’s concern is that the order will “materially impact” Paytm’s payments business, which accounts for 59% of revenue.

“While we do not believe the order is the end of Paytm’s journey, it has a material impact on near-term growth, profitability, forces another pivot and makes it necessary to restore the credibility and durability of the business,” he said. wrote Rudra in a note released to customers on February 1.

Not to be missed: India is winning over investors while Chinese stocks struggle, as these charts show.

A 97 said on Thursday that it is already working with various banks, not just PayTM Payments Bank, but will now “accelerate” plans to work more with other banks following the RBI’s order.

“Going forward, [the company] it will only work with other banks and not with Paytm Payments Bank Limited. The next phase of OCL’s journey is to continue to expand its payments and financial services businesses, only in partnership with other banks,” One 97 said in a statement.

JP Morgan’s Rudra said it “has to be proven” that Paytm can maintain payment margins as it migrates its business to other banks.

“We expect this to dent the credibility of Paytm’s consumer brand, which could lead to market share losses in segments dominated by Paytm in the past,” Rudra wrote.