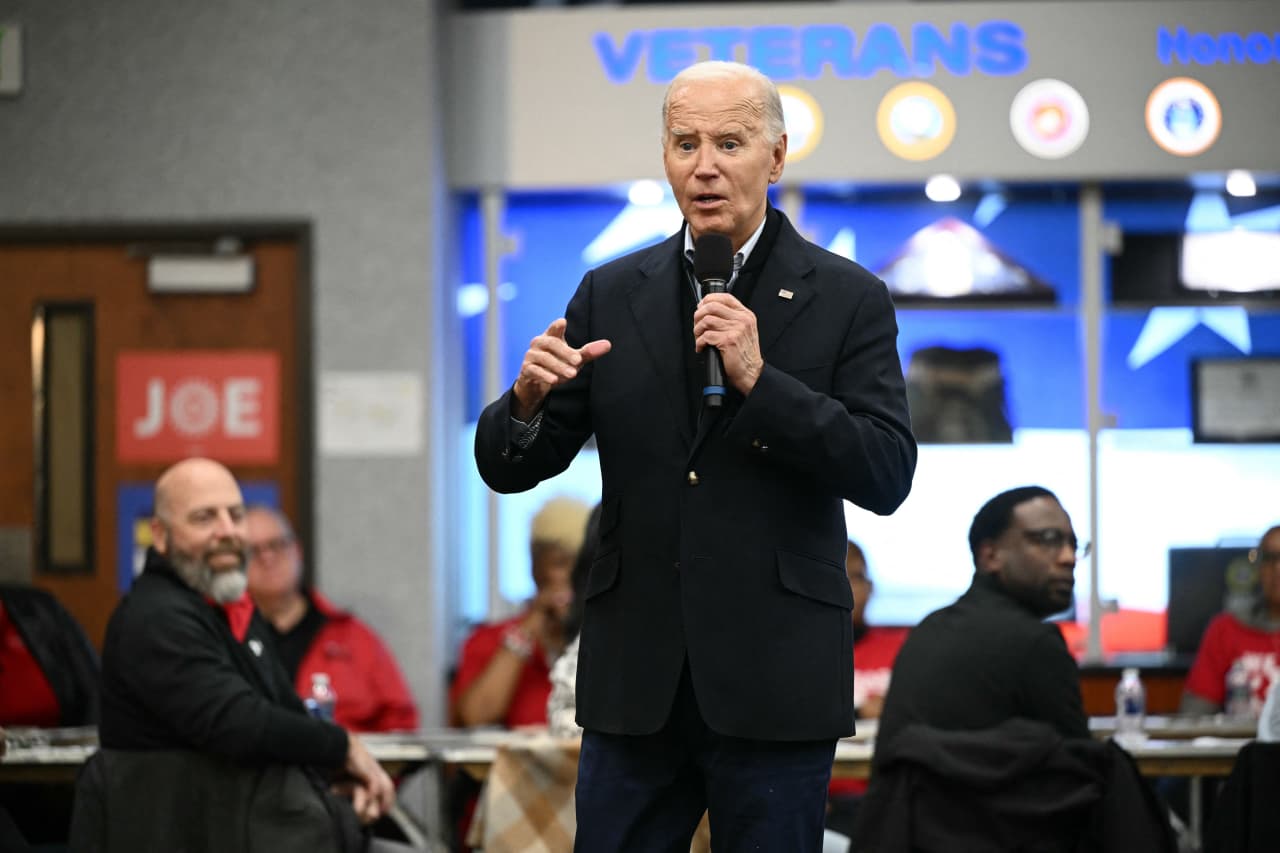

President Joe Biden released a statement Friday celebrating the latest report on the jobs explosion. They showed “another month of strong wage gains and job gains of more than 350,000 in January, continuing last year’s strong growth,” it said.

But beneath the surface, these latest jobs data could prove useless to the president’s reelection campaign. This is because they pose not one but two possible risks that could prove a headache in the months leading up to November: the risk of higher inflation, but also the risk of a recession.

In January, nonfarm payrolls data were double what economists had expected. The same goes for increasing hourly wages.

These figures are positive for workers and job seekers. But they raise concerns that Federal Reserve Chairman Jay Powell’s economic medicine is still not working as it should and that the economy is in trouble. Not to calm down.

“Wages rose to 0.6%, the highest level since March 2022,” writes Jeff Schulze, head of economic and markets strategy at ClearBridge Investments, in a note to clients. “This reading, combined with the overall jobs number, effectively takes the March rate off the table and should raise new concerns about the potential reacceleration of inflation.”

Context: The wage spike in January is probably not a warning sign about inflation. Here because.

See also: March rate cut? Even May now seems remote.

You can see this very clearly in the markets’ reaction to the data. Futures markets, which bet on future interest rates, have just once again cut bets on early interest rate cuts. It is also cutting its estimate of rate cuts in the second half of the year. If inflation doesn’t subside, Powell may be forced to keep rates higher for longer.

A month ago, futures markets predicted that the Fed would cut interest rates by about 1.25 percentage points between now and its September meeting (the last before the election).

Is that the best case scenario now? Between 0.75 and 1 point. Perhaps.

The market now gives a 10% chance that Powell will manage to cut no more than 0.5 points. Just a day ago, he set that probability at 0%.

Then there’s the interest rate that the Fed doesn’t control (directly, anyway), but which has an even greater influence on the economy: that of the 10-year Treasury bond BX: TMUBMUSD10Y.

The employment data caused the 10-year bond yield – below 3.9% moments earlier – to jump above 4%.

The 10-year rate is not only a key benchmark for corporate lending and financial markets; It is also the key rate used by lenders when setting interest rates on 30-year fixed mortgages.

So the latest jobs data could help keep mortgage rates higher for longer and postpone the day when they start to fall. As all homeowners and buyers in America know, today’s relatively high mortgage rates have helped freeze much of the housing market. Homeowners don’t want to give up those large fixed-rate mortgages they’ve locked up during the pandemic. Many are holding off on selling. And the shortage has helped drive up home prices, causing a crisis for those, especially younger people, looking to buy.

This is not good news.

(Donald Trump, incidentally, fully understands the importance of interest rates to his campaign. He went on Fox Business on Friday to pressure Powell to keep rates higher, complaining that the Fed chief was “ politician” and would have cut rates to favor Biden’s re-election – despite Powell being chosen by Trump to lead the Fed in 2017.)

President Donald Trump has formally nominated Jerome Powell as the next chair of the Federal Reserve, meaning there will be no second term for current chair Janet Yellen. WSJ’s Jon Hilsenrath explains why Trump decided to choose a new leader for the central bank. Photo: Getty

See: Initial market reaction: too hot

But if the nonfarm payroll data is useless, so is an entirely different set of numbers released by the Labor Department on Friday: those from a second survey, in which the government surveys households rather than employers.

These, surprisingly, do not show continued labor market strength. They are showing weakness.

Households reported that employment data fell last month. This jobs figure fell by 31,000 in January even on a seasonally adjusted basis (meaning you exclude things like temporary Christmas jobs). In fact, jobs have declined by 714,000 since November, and according to this survey, there are now fewer jobs in America than there were last summer.

Even more disturbing, the household survey shows that full-time employment – a key indicator of a healthy job market – peaked in June. It has since decreased by 1.6 million (again on a seasonally adjusted basis).

Other metrics that often indicate a weak job market also increased, such as the number of potential workers who gave up looking for work.

What is going on? The two surveys are conducted in parallel every month. But they are totally different. The first, the establishment survey, is aimed at employers. The other speaks to the “families”: workers and aspiring workers.

ClearBridge’s Schulze cautions that while both sets of data are important, the second survey – households – is sometimes a better future indicator and, in the past, has been quicker to pick up on big changes in the direction of the economy. And, he says, a more disturbing story has been told about the job market for a year.

“This divergence deserves attention,” he writes, “since the Household Survey has historically been more accurate at inflection points, indicating that job growth may be less impressive than it currently appears.”

In other words, if the economy were to go into recession this year after all, you might expect to see it emerge in the Household Survey before it appears in the better-known Establishment Survey, which produces non-profit payroll data. agricultural.

See: The jobs report is strong, make no mistake. But it was probably inflated by the January effect.

Whether the household survey indicates a recession or even stagnation is another question. Most economists believe that the United States will avoid a recession and that the Fed will successfully engineer a disinflationary soft landing (even if the rate cuts will come later than many had hoped).

The bets still point to a rosy scenario.

But the Household Survey numbers certainly look strange when compared to the Establishment Survey data that says we are experiencing an unprecedented job boom.

Learn more about the Nonfarm Payrolls report:

Soft landing for the economy? How about not landing? The United States continues to grow rapidly.

‘Explosion! What a way to start the new year’: Economists’ reaction to the jobs report

The US economy showed signs of recovery even before Friday’s jobs report