Oil prices rose on Friday, supported by OPEC’s decision to keep its oil production policy unchanged, although both benchmarks were set for weekly losses amid crisis-driven volatility in the Middle East.

The oil-producing group said it will decide in March whether or not not to extend the voluntary oil production cuts in place for the first quarter.

Crude oil has found support in expectations of interest rate cuts and rising geopolitical tensions, particularly attacks by the Iran-aligned Houthi group on Red Sea shipping, which threaten to disrupt trade and supplies from the region. Brent crude was trading above $81 a barrel on Thursday.

Meanwhile, in the precious metals complex, gold prices (HAUUSD: CUR) held near a one-month high as the market’s focus shifted to U.S. nonfarm payrolls data for further guidance on where the Federal Reserve is going after rates after data showed a rise in weekly US unemployment claims last week. Spot gold (XAUUSD:CUR) remained little changed at $2,054.37 an ounce as of 6 a.m. ET.

Gold is still in a “bad hangover” after the Fed’s reaction, but a small rally is occurring due to the number of early claims, Phillip Streible, chief market strategist at Blue Line Futures, told Reuters.

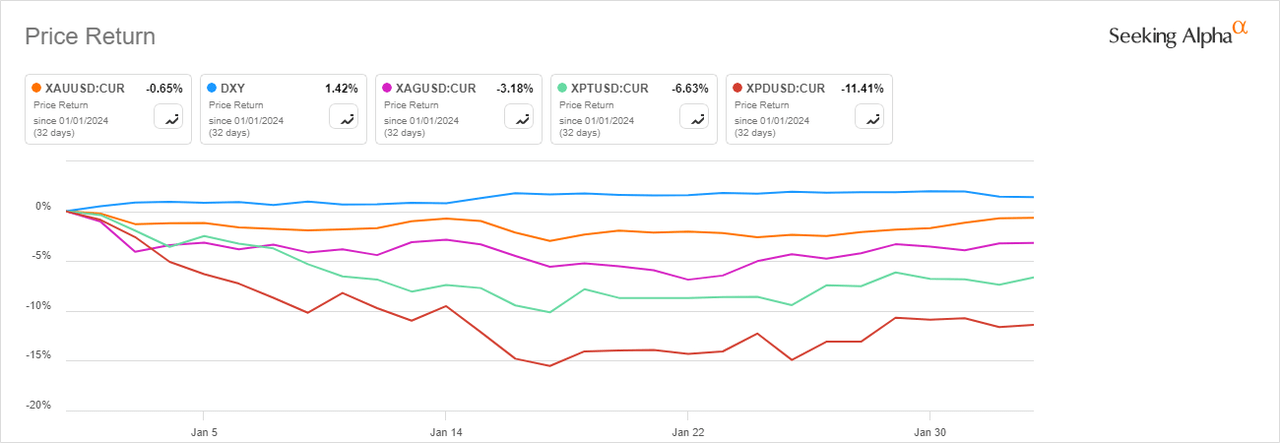

Year-to-date comparison of the price movement of gold, silver, platinum and palladium against the dollar.

Base metals, however, have come under pressure Copper futures headed for a weekly loss due to bets on delayed rate cuts and demand concerns in China. “However, supply-side issues remain on investors’ minds. The speed with which producers in the metals industry have closed capacity in the face of declining margins is unexpected. This should lead to a stabilization of prices, but further upside will depend on whether they maintain discipline until demand recovers,” ANZ analysts wrote in a note. Prices of metals, including nickel and lithium, remain well below the highest-cost producers, brokers said.

Elsewhere among agricultural commodities, soybean and cocoa prices fell, while wheat gained. According to reports, the USDA attaché predicts an increase in wheat production in Ukraine, increasing export estimates.

Recent movements in commodity prices

-

Power

- Crude Oil (CL1:COM) +0.68% at $74.32.

- Natural gas (NG1:COM) +1.40% at $2.08.

Metals

agriculture

Commodity ETFs

Gold ETFs:

- SPDR Gold Shares ETF (GLD)

- VanEck Gold Miners ETF (GDX)

- VanEck Junior Gold Miners ETF (GDXJ)

- iShares Gold Trust ETF (IAU)

- Direxion Daily Gold Miners Index Bull 2X Shares ETF (NUGT)

- Sprott Physical Gold Trust (PHYS)

Other metals ETFs:

- iShares Silver Trust ETF (SLV)

- Sprott Physical Silver Trust (PSLV)

- Global X Silver Miners ETF (SIL)

- US Copper Index Fund, LP ETF (CPER)

- abrdn Physical Palladium Shares ETF (PALL)

Oil ETFs:

- US Oil Fund, LP ETF (USO)

- Invesco DB Oil Fund ETF (DBO)

- US 12-Month Oil Fund, ETF LP (USL)

- US Brent Oil Fund, LP ETF (BNO)

- US Natural Gas Fund, LP ETF (UNG)

- US Gasoline Fund, LP ETF (UGA)

Agricultural ETFs:

- Invesco DB Agriculture Fund ETF (DBA)

- Teucrium Soy ETF (SOYB)

- Teucrium Wheat ETF (WEAT)

- ETF Teucrium Corn Fund (CORN)