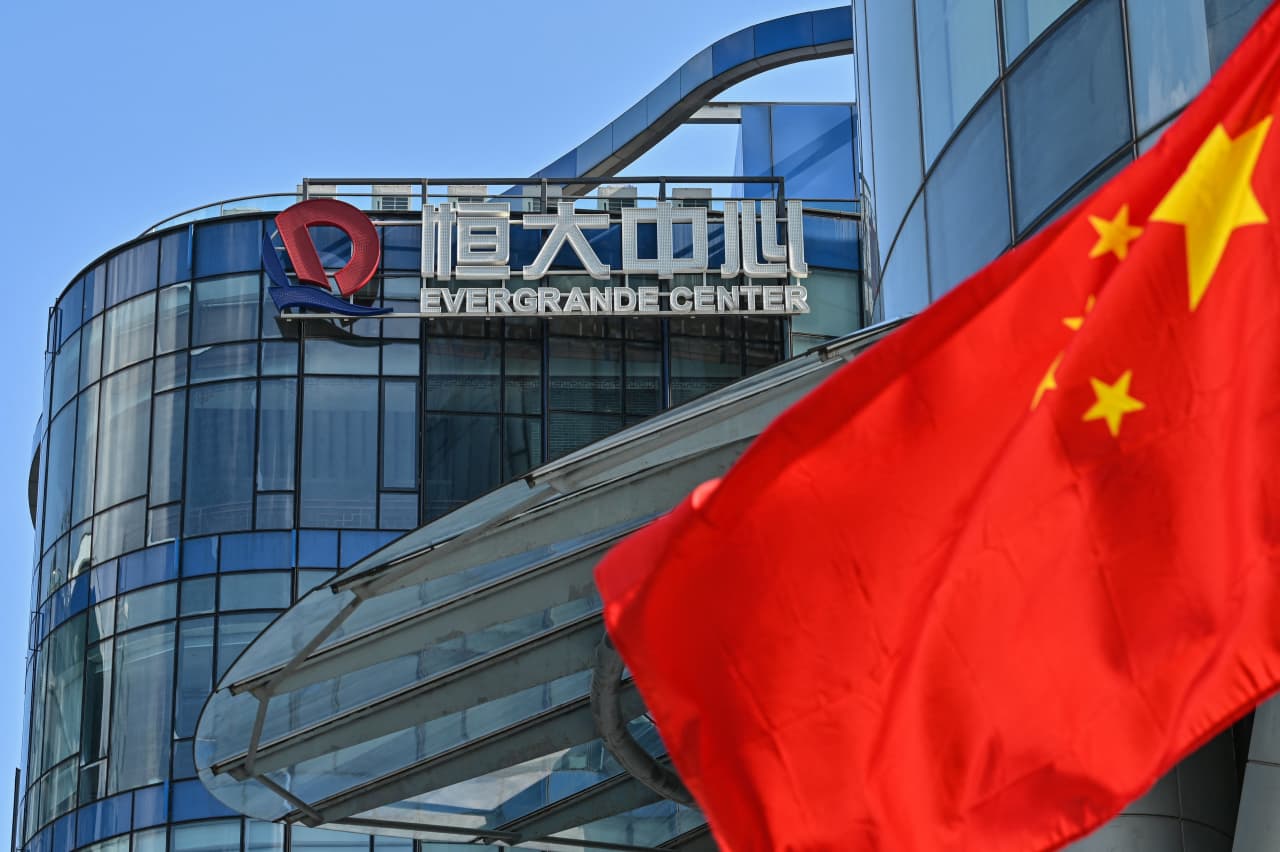

Troubled Chinese property developer Evergrande faces liquidation after failing to reach a restructuring deal with its creditors, according to multiple reports Sunday evening.

The Wall Street Journal reported that talks between Evergrande 3333,

and its creditors began last week with hopes of reaching a deal that would allow the company to continue operating, according to the Journal, which cited sources familiar with the matter.

But those talks collapsed, and on Monday a Hong Kong court ordered the company to be liquidated, in a stunning fall from grace, the New York Times and Bloomberg reported. Once China’s largest property developer, Evergrande has more than $300 billion in liabilities.

“Enough is enough,” Judge Linda Chan said in her ruling, according to the Journal.

A liquidation will likely impact China’s beleaguered real estate sector, which has been hammered in recent years as developers have fallen behind on debt while the Chinese government has cracked down on lending and property values have plummeted.

Monday’s court hearing for Evergrande was originally scheduled for December but was postponed to “fine-tune” its debt restructuring plan, the Associated Press reported last month.

Evergrande’s Hong Kong-listed shares have slumped around 90% over the past 12 months. A suspension of trading in the shares was ordered on Monday.